Our UNITISE software platform provides investment managers with the capability to manage funds administration, registry and investor communications efficiently in-house. Fund managers can easily:

Allot, redeem, transfer, and convert units

Keep up with regular compliance and reporting obligations

Engage with investors quickly and consistently

Perform distribution calculations and associated reporting

Utilise capital raising, deal flow management and CRM functionality

Meet compliance and regulation requirements like AMIT, AIIR, FATCA, CRS, GS007, RG97 and TMD.

Action capital calls and produce call notices

Deal with “Big Data” efficiently

Improve investor relations and investor experiences.

Unitise Funds Management Software does all the above in an easy-to-use and highly scalable platform. Maintain control by hosting your database on your own server tenancy or let us assist in setting up a cloud-based solution. Either way, you will have secure access from any device anywhere.

We specialise in migrating funds currently operating on spreadsheets or investment managers using outsourced services looking to return to in-house management.

Unitise is highly scalable and well suited to:

Property Trusts and Syndicates

Cash Management Funds

Contributory and Pooled Mortgage Funds

Equity Funds

Market Linked Investments

Fixed Income Funds

Any other type of unlisted security.

Download our Product Guide below for a detailed view of Unitise along with sample reports and database structure.

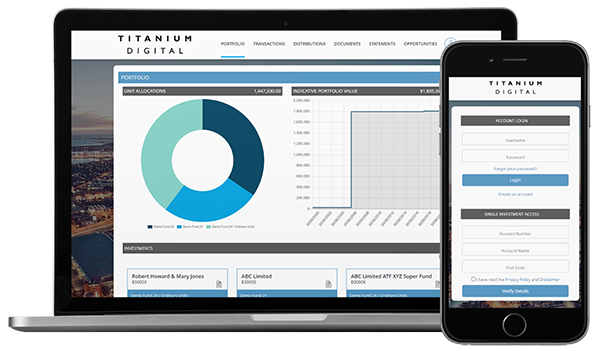

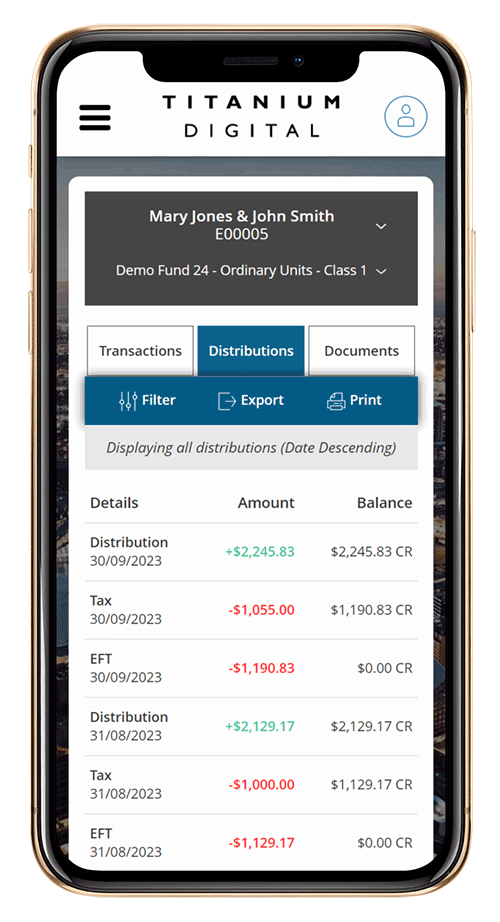

Our Investor Portal allows your investors, advisers and brokers to conveniently view and manage their investments online.

Offered as a completely white-labelled product, we're able to incorporate your branding into the portal to ensure it fits well within your existing website while installing it so that it is accessible from https://investors.yourdomainname.com.au (or the like).

Access one or multiple investments concurrently

View/Update contact details

View Unit Transactions

View Distributions, Tax Withholding and Payments

Download relevant periodic statements in PDF

Access registry forms

Customisable Privacy Policy and Disclaimer

With an increasing shift toward digital onboarding, our comprehensive online investor application process provides a world class investor experience designed to give your fund a competitive edge. Do away with paper based forms and provide your investors with a modern online application experience for both retail and wholesale environments. With straight-through processing of data, APPLICATE allows you to scale and approve applications efficiently.

Key features include:

Market multiple investment opportunities at once

User friendly application process for various investment entity types

New investor applications and existing investor top-ups

Monitor partly completed application progress

Real time AML/KYC verification

Active integrations with industry AML/KYC providers

Electronic ID Verification

Capture Wholesale Investor Certificates

Target Market Determination (TMD) for retail investors

Customisable declarations to suit your business

Digital signature capture using touchscreen devices

Downloading/printing of app form specifics

APPLICATE does away with manual processes reducing the potential for transposition errors and omissions whilst also reducing the load placed on your admin staff and ultimately reducing operational costs.

Our system has been through rigorous testing processes and has proven itself over the years to produce consistently accurate results, in line with industry expectations.

Titanium Digital is an ISO27001 (information security) certified organisation. UNITISE was built around compliant security policies to ensure your data is kept secure.

We are committed to offering compliant solutions to the market and providing regulatory updates to our clients as part of support and maintenance arrangements. You will also receive software enhancements and upgrades as part of our licencing model.

We implement controls to assist with GS007 compliance, such as two-part processing and audit reporting/logging. The system is designed to prevent errors, omissions and fraudulent processing.

Our off-the-shelf solution provides clear and detailed reports and statements that can be generated in batch at the click of a button. Outputs can be printed, emailed or copied to our investor portal for secure access.

Our systemised processes are designed to greatly improve process efficiencies. You will find Distributions, Redemptions, Capital Calls etc. faster to process and with greater confidence.

Scalability is at the heart of everything we do. We love to support clients throughout their growth trajectories and have seen many multiply their operations by many orders of magnitude.

Our systems are designed to be delivered via industry-standard cloud services such as Microsoft Azure and Amazon Web Services so your data is always available. In addition, every single one of our reports provides for CSV output so you will be able to extract data as necessary.

UNITISE funds management software seamlessly integrates with INFUSE lending management software, allowing for more efficient data flow and enhanced operational performance so that mortgage fund managers can provide top-of-class services to their investors and borrowers. Off-the-shelf integrations are also available to several third party services, such as advisor networks, money-markets, ID verification service providers and PEP checking services.

We can also to tailor integrations with major CRM providers such as Hubspot and Salesforce if required. And, if you have completely bespoke requirements that demand a customised solution via API, our development team will be there to assist.